A strategic adjustment to a portfolio of stocks and bonds

Our investment process integrates an option-based overlay strategy with a hedged globally diversified portfolio to grow and preserve wealth. This approach results in well-balanced portfolios that are optimized to mitigate losses, achieve consistent returns, aligned with our client’s investment objectives and risk tolerance.

Benefits of options-based, ETF and bond strategies

Income

We can use a conservative options strategy to generate income with of ETFs and bonds.

Stability

While many investments zig and zag, using options, EFTs and bonds smooth your returns.

Risk

Options are a strategic way to manage your portfolio’s risk in all market conditions.

Consistent income generation

Options are often perceived as high-risk investments, but when used appropriately and without leveraging, they can offer a conservative approach to generate additional income or enter the equity market at a reduced cost. This can be achieved by properly selecting and executing option strategies that align with the investor’s risk tolerance and financial goals.

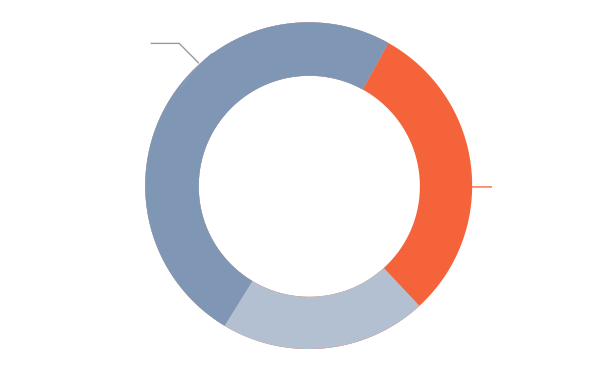

Resilience during past economic downturns

The integration of options trading into a globally diversified portfolio can serve to mitigate fluctuations in returns and lessen the impact of market downturns, while preserving the potential to realize gains in both stable and upward trending markets.

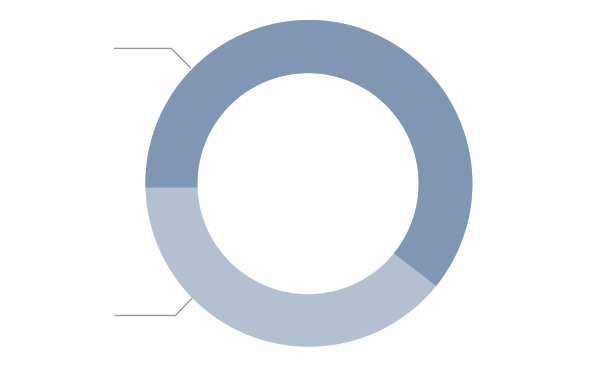

Striking a Balance for Optimal Return Potential

We can design a strategy that can dramatically outperform declining markets while still benefiting from upward market movements, depending on one’s investing goals and level of risk tolerance.

Important Details

Are you a fiduciary?

Yes, we are a fiduciary. A fiduciary is a person who holds a legal or ethical relationship of trust with one or more other parties, person or group of persons. We are committed to always putting our clients’ interests ahead of our own.

Where are my investments held?

Our investment management services utilize Interactive Brokers as the platform.

Where do you service clients?

We hold the conviction that geographic location should not determine the quality of client experience. Regardless of where our clients reside, we strive to provide equal levels of attention to detail and ensure that their experience with us is seamless and satisfactory.

What are the fees?

Our fees range from 0.75% to 1.75% of assets under management. See advisor fees for more details here.